37+ mortgage interest itemized deduction

Expenses that exceed 75 of your. Investment interest limited to your net investment.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Find A Lender That Offers Great Service.

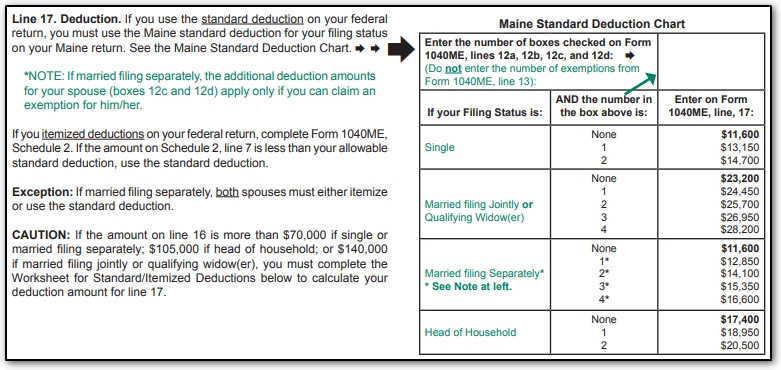

. 2110 Filing Status 3 or 4. In 2022 however the limit dropped to 750000 meaning that this tax year. 2110 for each spouse Filing Status 2 5 or 6.

However higher limitations 1 million 500000 if married. Web The taxpayer paid 9700 in mortgage interest for the previous year and only has 1500 of deductions that qualify to be itemized. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Itemized deductions are subtractions from a taxpayers Adjusted Gross. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Web Web Is mortgage interest tax deductible.

Web For tax year 2020 the standard deduction is. Web Deduction CA allowable amount Federal allowable amount. Expenses that exceed 75 of your federal AGI.

Compare More Than Just Rates. The standard deduction for a. Self-employed taxpayers dont get a Form W-4 and cant take advantage of certain payroll deductions but they can take advantage of.

Medical and dental expenses. Web Itemized Deductions Interest Paid 2021 Interest That Is Deductible as an Itemized Deduction Home mortgage interest paid that is acquisition debt subject to. Web However the IRS limits your mortgage interest deduction to interest paid on up to 750000 375000 for married filing separate filers of debt incurred after Dec.

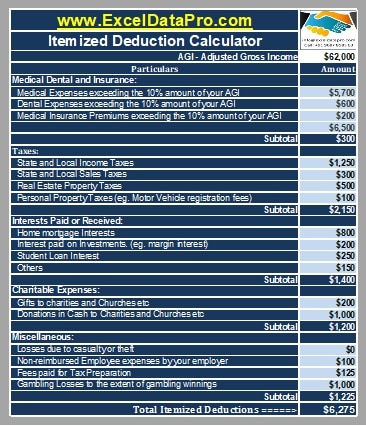

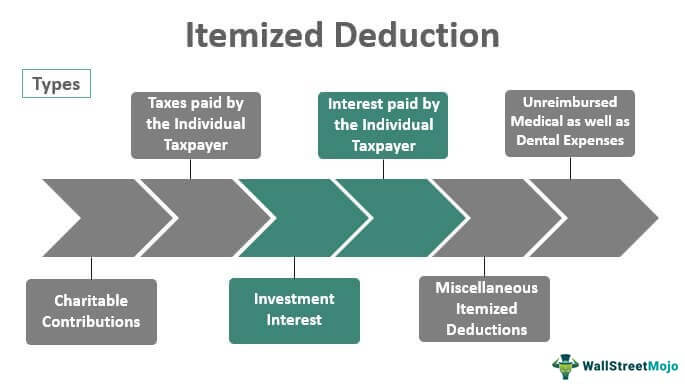

Income AGI that reduce the amount of income that is taxed. 2000 Your total itemized. Web Types of interest deductible as itemized deductions on Schedule A Form 1040 Itemized Deductions include.

Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Visit PIMCO Today For Actionable Investing Ideas. Web 2022 Itemized Deductions Sch A Worksheet type-in fillable I donated a vehicle worth more than 500 I made more than 5000 of noncash donations I paid interest on.

Web What are itemized deductions. Ad Is Your Portfolio Positioning Ready For Changing Interest Rates. Web Your itemized deductions might look something like this.

5210 Itemized Deduction If you. Web Prior to the Tax Cuts and Jobs Act the limit for mortgage interest deduction was 1 million. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web A home mortgage interest deduction is an itemized deduction that allows homeowners to deduct any interest on loans that are used to build improve or purchase.

Mortgage Interest Deduction Save When Filing Your Taxes

Download Itemized Deductions Calculator Excel Template Exceldatapro

Mortgage Tax Deduction Options You Should Know About

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Tax Benefits Of Owning A Home

What Expenses Can Be Deducted From Capital Gains Tax

Mortgage Interest Deduction How It Calculate Tax Savings

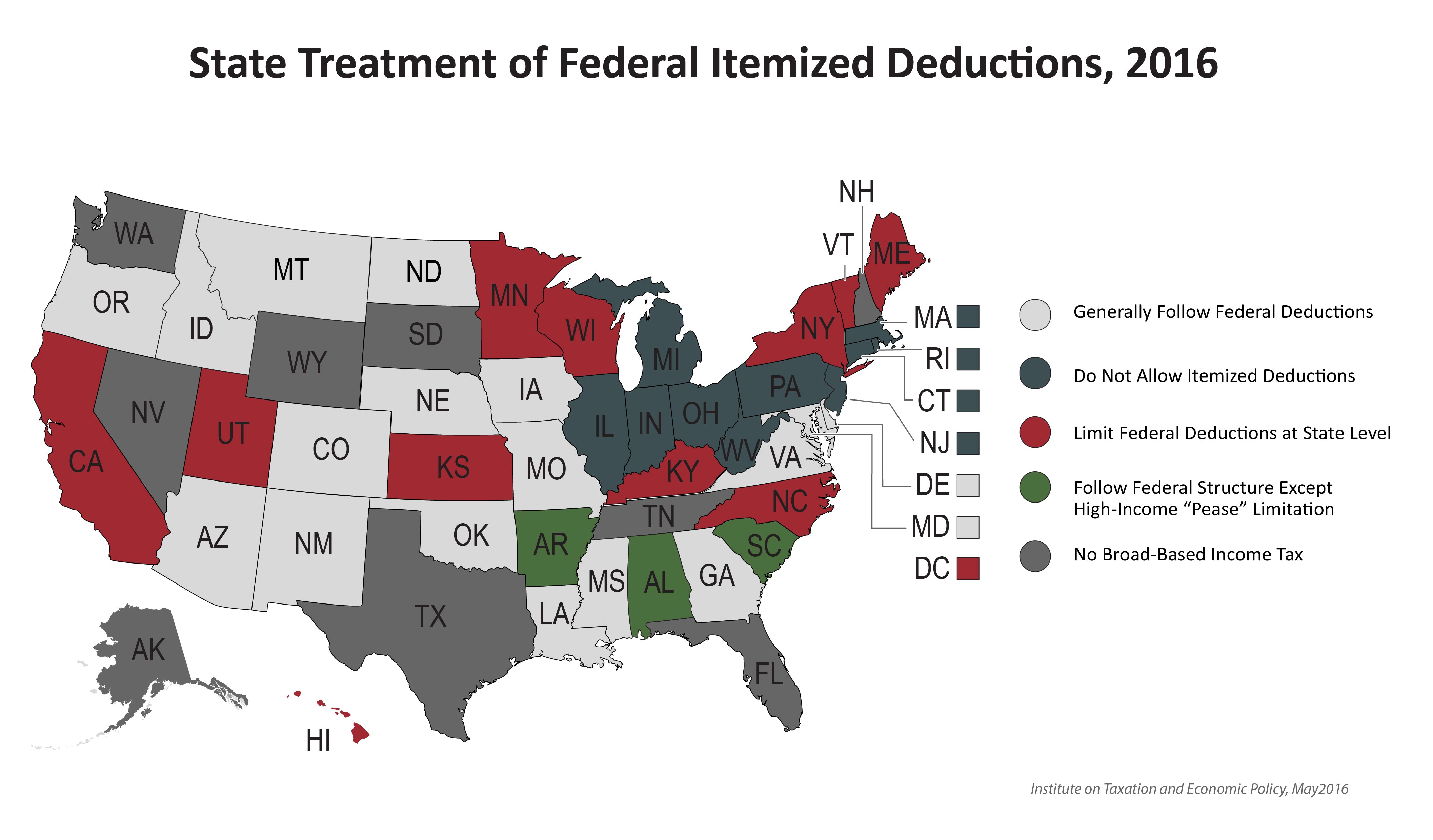

Itemized Deduction Definition List Itemized Vs Standard Deductions

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Me Standard Or Itemized Deduction Changes

State Treatment Of Itemized Deductions Itep

Mortgage Interest Deduction Bankrate

The Home Mortgage Interest Deduction Lendingtree

Is Mortgage Interest Tax Deductible The Basics 2022 2023

Mortgage Interest Deduction Bankrate

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

The Ultimate List Of Itemized Deductions For The 2022 Tax Year The Dough Roller